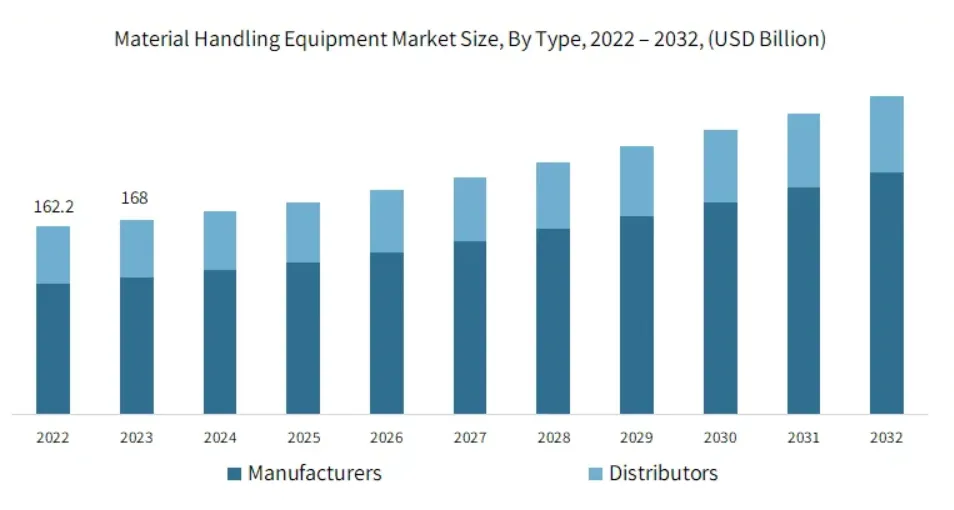

The correlation between material handling equipment (MHE) shipments and raw steel demand remains one of the most reliable indicators of industrial health. For 2026, our analysis projects a weighted increase in MHE shipments of approximately 5.2% year-over-year, which will drive a parallel rise in specialized steel demand, specifically for High-Strength Low-Alloy (HSLA) and abrasion-resistant grades. This growth is not uniform; it is heavily skewed toward automation-ready chassis and structural components for Autonomous Mobile Robots (AMRs) and automated storage systems. While total steel tonnage may see only modest gains due to the lightweighting of machinery, the value and technical complexity of the alloys required—such as those supplied by MWalloys—will reach unprecedented levels. Procurement managers must anticipate tighter supply chains for quenched and tempered plates, while engineers must prepare for a shift toward higher yield strength materials to accommodate energy-efficient equipment designs.

What Are the Projected MHE Shipment Volumes for 2026?

The trajectory for 2026 material handling equipment shipments is defined by a "replacement plus expansion" cycle. Following the post-pandemic boom and the subsequent inventory correction of 2024, 2026 is positioned as a stabilization and growth year. The primary driver is no longer simple warehousing expansion but the retrofit of existing facilities with high-density automation.

Data modeling suggests that traditional internal combustion lift trucks will see flat shipment numbers. In contrast, Class 2 and Class 3 electric motor trucks and AGV (Automated Guided Vehicle) systems are expected to see shipment surges exceeding 8%. This distinction is critical for steel forecasting. Electric and automated units require different steel profiles compared to their heavy diesel counterparts. The chassis requires less bulk mass for counterweighting but significantly higher tensile strength to maintain structural integrity while housing heavy battery packs.

MHE Shipment Growth Forecast by Category (2026)

| Equipment Category | Projected Growth (YoY) | Primary Steel Impact | Dominant Alloy Types |

| Industrial Trucks (Class 1-3) | +6.5% | Chassis & Counterweights | A36, A572 Gr 50, Cast Iron |

| Conveyors & Sortation | +4.2% | Rollers, Frames, Supports | Cold Rolled Sheet, Galvanized, Stainless 304. |

| Overhead Cranes & Hoists | +3.1% | Structural Beams, Wire Rope | ASTM A992, 4140 Alloy, High Carbon Wire. |

| AGVs & AMRs | +12.8% | Precision Frames, Gears | 1045, 8620 Alloy, Aluminum-Steel Composites. |

| Racking & Shelving | +3.5% | Roll Formed Profiles | High-Strength Strip Steel, Structural Tubing. |

This shipment data serves as a direct input for raw material procurement. If your production line focuses on conveyors, the demand is volume-based flat-rolled steel. If you manufacture forklifts, the demand shifts toward heavy plate and bar stock.

How Will 2026 Equipment Trends Alter Steel Demand Specifications?

The sheer volume of shipments tells only half the story. The type of steel required is undergoing a fundamental shift. Engineers at major OEMs are under pressure to design equipment that consumes less energy. This necessitates a reduction in dead weight, forcing a transition from mild carbon steels to advanced alloy steels.

The Shift to High-Strength Low-Alloy (HSLA)

In previous decades, A36 structural steel was the standard for conveyor frames and rack columns. For 2026 designs, we observe a distinct pivot toward ASTM A572 Grade 50 and Grade 65. These materials allow manufacturers to use thinner gauges without sacrificing load-bearing capacity. For MWalloys clients, this means a purchasing strategy focused less on tonnage and more on specific mechanical properties.

Impact of E-Commerce Velocity on Wear Parts

The duty cycle of material handling equipment in 2026 is forecasted to be 30% higher than in 2020. Warehouses operating 24/7 place extreme stress on moving parts. Consequently, demand for Abrasion Resistant (AR) plate—specifically AR400 and AR500—is projected to outpace standard structural plate. Components such as chute liners, hopper walls, and forklift tines must resist wear to minimize downtime.

Which Economic Factors Will Dictate Steel Availability in 2026?

Procurement professionals must navigate a complex matrix of economic indicators to secure inventory at favorable rates.

1. The Green Steel Premium

By 2026, regulations in the EU and North America regarding embodied carbon will influence sourcing. Steel mills utilizing Electric Arc Furnaces (EAF) powered by renewables will command a premium. MHE manufacturers exporting to global markets will be forced to prove the recycled content of their steel. This creates a bifurcated market; "Green Steel" for premium, export-grade equipment, and conventional blast furnace steel for domestic, price-sensitive applications.

2. Global Scrap Supply Constraints

As EAF production increases, the competition for high-quality ferrous scrap (prime scrap) intensifies. MHE shipments rely heavily on steel produced via EAF due to the prevalence of long products (beams, bars). A tightening scrap market in 2026 could lead to volatility in surcharges, specifically affecting the pricing of alloy staples like Molybdenum and Nickel, which are essential for hardening gears and shafts in transmission systems.

3. Reshoring and The Manufacturing Supercycle

The US manufacturing construction boom initiated in the early 2020s will reach operational maturity in 2026. This means the domestic factories built today will be buying forklifts and conveyors tomorrow. This domestic demand acts as a floor for steel prices, preventing deep corrections even if the broader global economy cools.

Analyzing the Steel Supply Chain for MHE Components

Understanding the supply chain nodes helps in mitigating risk. The journey from iron ore to a finished forklift mast involves multiple transformation steps, each susceptible to disruption.

Rolling Mill Capacity vs. Demand

While raw steelmaking capacity is sufficient, finishing capacity for specialized products often creates bottlenecks. For example, heat-treated alloy bars used in hydraulic cylinder rods (a critical MHE component) have limited production lines. In 2026, as shipments of hydraulic-heavy equipment rise, lead times for these specific turned, ground, and polished (TG&P) bars could extend from weeks to months.

Component-Specific Material Breakdown

| MHE Component | Critical Steel Grade | Supply Risk Level (2026) |

| Forklift Tines | 4140 / 4340 Alloy Steel | Medium (Alloy Surcharges) |

| Hydraulic Cylinders | 1045 Chrome Plated | High (Plating Capacity) |

| Conveyor Bearings | 52100 Bearing Steel | Low (Commodity) |

| Crane Booms | Strenx / Weldox (High Yield) | High (Import dependency) |

| Rack Uprights | HRC (Hot Rolled Coil) | Medium (Mill Utilization) |

Engineering Considerations: Selecting Alloys for Next-Gen MHE

For the design engineer, 2026 requires a balance between manufacturability and performance. MWalloys recommends a thorough review of the following material properties when specifying for new equipment lines.

Machinability vs. Hardness

Automated machining centers require consistent material structures. Inclusions in cheap imported steel can wreak havoc on CNC tooling. For 2026, specifying "clean steel" with vacuum degassing processes becomes cost-effective by reducing scrap rates during the machining of complex gears for AGV drive units.

Weldability in Automation

As robotic welding becomes the norm for manufacturing MHE frames, the chemical composition of the steel (Carbon Equivalent) must be tightly controlled. High variations in carbon content lead to weld cracking or the need for expensive pre-heating. Utilizing controlled-chemistry grades ensures that the automated assembly lines running in 2026 maintain high uptime.

Strategic Sourcing: How Procurement Should Prepare for 2026

To safeguard margins against the projected shipment increases, procurement teams should adopt the following strategies.

-

Index-Linked Contracts: Move away from spot buying for core commodities like HRC and Plate. Link contracts to CRU or Platts indices to ensure transparency.

-

Vendor Managed Inventory (VMI) for Alloys: For lower volume, high-value items like 4140 or tool steels, establish VMI programs with distributors like MWalloys to buffer against lead time shocks.

-

Dual-Sourcing Qualification: Ensure that engineering has approved at least two mills or sources for every critical steel spec. Do not rely on a single proprietary grade if a generic standard (ASTM/SAE) can suffice.

The Role of MWalloys in the 2026 Ecosystem

In an environment characterized by rising technical demands and shipment volumes, MWalloys serves as the bridge between metallurgical science and supply chain logistics. We do not simply sell metal; we provide the technical data required to optimize the weight and durability of material handling equipment. Whether it is sourcing rare diameter alloy bars for heavy-lift hoists or providing high-volume sheet for conveyor manufacturers, our inventory planning is aligned with the 2026 shipment forecasts detailed above.

Frequently Asked Questions (FAQs)

Will steel prices increase in 2026 due to higher MHE shipments?

What is the best steel grade for forklift forks in 2026?

The industry standard remains 4140 alloy steel or modified 15B37 boron steel. These grades offer the necessary toughness and hardenability to prevent deformation under heavy loads during 24/7 warehouse operations.

How does the rise of AGVs impact steel procurement?

Is stainless steel demand rising for MHE?

What are the lead times for heavy plate in 2026?

Can we substitute A36 with A572-50 for conveyor frames?

Yes. A572-50 offers higher yield strength, allowing for lighter sections. This reduction in weight can significantly lower shipping costs and motor power requirements without compromising load capacity.

How will tariffs affect MHE steel costs in 2026?

What is the impact of "Green Steel" on manufacturing costs?

Currently, Green Steel commands a 10-20% premium. By 2026, as hydrogen-based production scales, this premium should compress. It is an essential investment for companies with strict ESG (Environmental, Social, and Governance) mandates.