At 2026, benchmark hot rolled coil prices sit in a broad band from roughly $440 to $1,100 per metric tonne depending on product grade, coating and region. Typical ranges you will see in market reports today are: China export offers near $460 per tonne, U.S. mill/spot HRC around $950–980 per short ton (equivalent to about $1,050–1,085 per metric tonne), and India wholesale CRC/HRC in the $550–$700 per metric tonne zone depending on product and city. These levels reflect the combined effect of stronger upstream commodity costs, regional trade policy, and inventory tightness.

1. What exactly does "steel coil price per ton" mean

When people ask about "steel coil price per ton" they usually refer to the delivered or mill price for a length of steel processed and wound into a coil. The most common coil types are hot rolled coil (HRC), cold rolled coil (CRC) and coated / galvanized coil. Prices can be quoted per short ton, metric tonne, or in local currency. For international benchmarking use metric tonnes (MT) or specify the short ton conversion (1 short ton = 0.907185 MT). Always confirm whether the quote is FOB mill, CIF port, or delivered which includes freight, insurance, duties and local handling.

2. How prices are typically quoted and units to watch

-

Unit terms: metric tonne (MT), short ton (st), or kilogram. Many US sources still use dollars per short ton; global commodity trackers use $/MT. Convert when comparing.

-

Trade terms: FOB mill means seller responsible until the material leaves the mill; CIF means seller covers freight and insurance to an agreed port; Delivered Duty Paid means seller covers taxes and clearance. Price differences across these INCOTERMS can be hundreds of dollars per tonne once ocean freight, insurance, and duties are included.

-

Product definition: thickness, width, temper, coating and tolerance affect the final price. A standard hot rolled coil has a different benchmark than a precision cold rolled coil or galvanized coil.

-

Spot vs contract: spot prices reflect immediate or very near-term availability. Contract prices are often fixed for a month, quarter, or year and include volume and delivery terms. Market participants use both for different procurement strategies.

3. 2026 price snapshot — China, United States, India (comparison table)

Notes: prices below are representative market benchmarks from industry trackers and official data in Jan–Feb 2026. They are shown both in local terms if reported and as approximate USD per metric tonne for easy comparison. Exchange rates used: 1 CNY ≈ $0.1441 and 1 INR ≈ $0.90 (approx 1 USD = 90 INR) based on early February 2026 spot levels. Sources listed below table.

| Region | Typical product | Quoted price (local) | Approx USD / metric tonne | Typical trade term / comment |

|---|---|---|---|---|

| China (domestic) | Hot rolled coil (domestic index) | ~3,070 CNY / MT (Feb 6, 2026) | $442 / MT | Domestic benchmark; index-linked. |

| China (export) | Hot rolled coil (offers) | Export offers near $465–$470 / MT | $465–$470 / MT | Export offers from major mills observed in early Feb 2026. |

| United States | Hot rolled coil (spot/mill) | ~$950–980 per short ton | $1,047–$1,081 / MT (approx) | SMU and futures point to HRC in this band; short ton quoted; convert for MT. |

| United States | Cold rolled coil | ~$1,080–1,140 per short ton | $1,190–$1,255 / MT (approx) | Cold rolled premiums over HRC. |

| India (wholesale city level) | Cold rolled coil | ~62,940 INR / MT (Jan 2026) | ~$696 / MT | CEIC month-end retail/wholesale index for Delhi CRC. |

| India (industry trade) | Hot rolled coil | Price bands reported ~₹50,250–₹51,250 / MT (Jan 2026) | ~$556–$567 / MT | Reported ranges from industry consultancy in Jan 2026. |

Interpretation and caveats

-

China export offers around the mid-$400s per tonne reflect mills’ competitive positioning for overseas buyers and do not include domestic duties and inland logistics. Domestic China indices are in CNY/MT and convert to USD in the low $400s at current exchange rates.

-

The US spot bands reported by market newsletters are often per short ton; once converted to metric they appear higher than China export offers. US pricing includes North American structural demand and local mill cost structure and is influenced heavily by tariffs and domestic capacity utilization.

-

Indian city-level indices can vary by grade and local demand; conversion to USD uses prevailing exchange rates which can shift quickly.

4. Why product type changes price so much

Different coils carry different processing cost and margin:

-

Hot rolled coil is the baseline mill product and is usually the cheapest per tonne on a comparable basis. It is suitable for many downstream uses but lacks surface finish.

-

Cold rolled coil is processed to tighter tolerances and better surface finish; that adds energy, labor and yield loss and raises price.

-

Galvanized or prepainted coils have coatings that add both material cost and processing steps; these typically carry the highest premiums.

-

Alloying or special tempers such as stainless, weathering grades or high strength steels carry substantial premiums beyond the carbon flat products discussed above.

When comparing quotes, ensure identical product specs: width, thickness, surface treatment, coil weight, and tolerances.

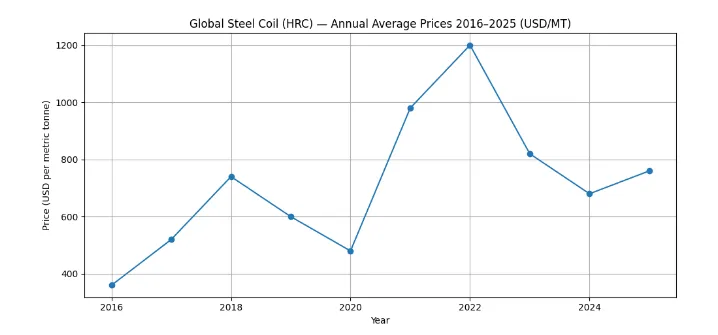

5. Past 10-year global market price movement — summary and table

Market trackers and industry benchmarks show the following broad phases during 2016–2025, which set the stage for the 2026 levels above: recovery from the 2015–2016 global steel trough; cyclical strength 2017–2018; pandemic shock and recovery 2020–2021; a stimulus and supply shock driven spike in 2021–2022; correction in 2023; then stabilization and renewed firming into 2025–early 2026. SteelBenchmarker and Trading Economics give the numerical evolution for hot rolled band and other flat products.

| Period | Key price character (HRC / flat) | Why it moved |

|---|---|---|

| 2016 | Low cycle trough | Weak global demand; China destocking |

| 2017–2018 | Recovery and spike | Construction and manufacturing rebound; capacity controls in China |

| 2019 | Softening | Trade tensions, slower global manufacturing |

| 2020 | Collapse then rebound | COVID-19 demand shock followed by stimulus |

| 2021–2022 | Large spike | Strong demand recovery plus supply chain / energy bottlenecks |

| 2023 | Correction | Normalization and lower downstream demand |

| 2024–early 2026 | Firming and regional divergence | Inventory tightness in some regions, policy shifts and commodity feedstock dynamics. |

A careful procurement team will review monthly indices rather than single-day quotes because the flat market moves on macro shocks, inventories and short-term freight/duty shifts.

6. What drove prices recently (2024–2026 evidence)

Key drivers with supporting evidence:

-

Upstream raw material costs: iron ore and coking coal moves materially affect mill margins. When ore rallies, mills pass cost through to coil prices. Market trackers show these linkages continuously.

-

China production and export behavior: China’s domestic policy, export offers and seasonal restarts affect global supply. Early 2026 China export offers returned to the mid-$400s/ton as mills sought export outlets.

-

Regional trade measures and tariffs: changes in tariffs or safeguard duties influence where large volumes flow and can change local price bands. India introduced safeguard duties to curb cheaper imports in late 2025, which influenced local pricing and export flows into India.

-

Logistics and lead times: longer lead times or shipping cost spikes can widen the spread between FOB and CIF pricing. US market updates showed lead times for certain CRC products extended to multiple weeks in late 2025.

-

Domestic demand and infrastructure cycles: government stimulus, construction cycles and manufacturing activity are central demand levers. News and industry reports in early 2026 point to stronger manufacturing in some regions supporting domestic premiums.

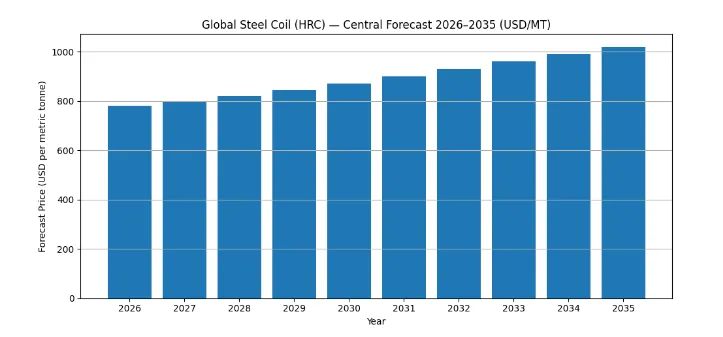

7. What could happen in the next 10 years — structured scenarios

Forecasts are inherently uncertain. Below are three plausible scenarios with practical signals to watch.

Baseline scenario (moderate growth)

-

Global GDP and industrial activity grow in line with consensus. China’s incremental capacity is managed and exports remain competitive but stable. Prices trend gradually higher in real terms with periodic volatility.

Implication: plan contracts with rolling monthly or quarterly price review windows.

Upside scenario (structural tightness)

-

Accelerating infrastructure programs across multiple regions plus supply constraints for raw materials. Tariff barriers reduce arbitrage to lower-cost regions. Prices firm substantially and premiums widen for coated and precision grades.

Implication: secure long lead-time contracts and consider forward purchases.

Downside scenario (demand slowdown)

-

Global trade weakness and demand destruction due to prolonged recession in key markets; surplus exports depress prices.

Implication: favor flexible contracts, capacity to scale down orders, and include inventory hedging.

Practical watchlist (indicators to monitor): monthly HRC benchmark reports, iron ore futures and port inventories, China export offers, regional safeguard or anti-dumping actions, shipping freight indices. Sources for present movement: industry benchmarks and news wire reporting.

8. How to compare quotes from different countries reliably

-

Normalize units: convert short tons to metric tonnes if needed. 1 short ton = 0.907185 MT.

-

Clarify INCOTERM: a $/MT FOB mill quote is not the same as CIF a port near you. Add freight, insurance, customs duty and inland logistics when comparing true landed cost.

-

Include handling and coil preparation: slit, edge trim, inner/outer packaging and coil weight tolerance matter.

-

Confirm grades and tests: chemical composition certificate, mill test report and stamping requirements. They affect usability and price.

-

Currency exposure: ask for quotes in the same currency or agree a forward mechanism; FX moves can easily change landed cost by tens of dollars per tonne. Use current exchange rates for conversion and show the date of the FX used. We used early-February 2026 spot rates for USD/CNY and USD/INR when building the table above.

9. Procurement checklist — what to confirm before placing a tonnage order

-

Exact grade/specification (HRC/CRC/Galv, thickness and width, coil inner diameter, coil weight)

-

Test certificates required (MTR, tensile, chemical analysis)

-

INCOTERM and whether price is FOB, CIF, DDP or delivered to plant

-

Delivery schedule, minimum coil weight and allowable coil variation

-

Packaging and transit requirements for export/import (sea-fastening, weatherproofing)

-

Lead time and penalty or force majeure clauses

-

Payment terms and acceptable payment instruments (LC, T/T)

-

Customs duties, VAT, and any safeguard or anti-dumping duties applicable in importing country

-

Warranty, acceptance test procedure and claim window

-

Logistics partners and insurance policy coverage

10. Risk management and recommended contract clauses

-

Price adjustment clause: link contract price to a publicly recognized monthly HRC index or specify formula for raw material pass-through.

-

Force majeure: be specific about what qualifies and include a notice and mitigation requirement.

-

Inspection and acceptance: define sampling method, test labs and acceptance window; specify consequence of failed tests.

-

Allocation and delay remedies: include options for partial shipments, substitutions with buyer approval and liquidated damages for late delivery.

-

Exchange rate clause: if you accept quotes in foreign currency, consider a cap/floor or allow FX pass-through to prevent open currency risk.

11. Steel Procurement & Global Logistics FAQ

1. Should I buy spot or sign a yearly contract?

2. How much does freight affect the CIF price per tonne?

3. How big is the typical price difference between HRC and CRC?

This spread accounts for additional processing steps, higher energy consumption, and yield loss during the cold-reduction process. Industry indices like SMU often show significant fluctuations in this spread.

4. Is China always the cheapest source for steel?

5. What are the fastest indicators of a steel price turn?

6. Can exchange rates swing landed cost materially?

7. How should I handle quality disputes in international trade?

8. What is the best way to hedge steel price exposure?

9. How long are lead times for coated or CRC products?

10. Where do I find reliable monthly benchmark prices?

12. Appendix — methodology, sources and a short note

Methodology used for tables and narrative

-

Regional price points were taken from published benchmark reports, industry newsletters and official statistical series for January–early February 2026. Where quotes were reported per short ton they were converted to metric tonnes using the standard conversion factor and rounded for readability. Currency conversions used early-February 2026 spot exchange rates. Major sources include SteelBenchmarker, Trading Economics, Steel Market Update and CEIC, plus timely reporting from Reuters and trade press.

Primary sources referenced in article

-

SteelBenchmarker monthly and historical series for hot rolled band and benchmark points.

-

Trading Economics commodity dashboards for HRC and broader steel price indices.

-

Steel Market Update surveys and weekly price ranges for North America.

-

CEIC / India monthly series for CRC wholesale price in Delhi (Jan 2026).

-

Megaproject and industry news for China export offer behavior in early Feb 2026.

-

Reuters reporting on India export/import dynamics and safeguard duties.

Final practical recommendations for MWalloys procurement and product teams

-

Set up a small price desk to monitor weekly HRC/CRC indices and iron ore futures. Reacting to weekly moves is better than relying on one quote.

-

When you request supplier quotes, always request the same spec, the same INCOTERM, and ask for mill test reports up front.

-

Use a two-tier buying policy: cover 60–75 percent of projected demand with fixed-quarter contracts and buy the remainder on spot to capture attractive dips or to source specialty grades.

-

Regularly review FX exposure; if you buy from China or India priced in local currency, consider a hedging rule or price adjustment clause.

-

Keep a documented supplier qualification checklist that includes lead time history, on-time delivery metrics and complaint resolution performance.